defer capital gains tax stocks

As the investment is an untaxed gain the. Ad Were here for you through the tax season and beyond.

Deferring Capital Gains Potential Benefits Russell Investments

Ad Go See Estimated Capital Gain Distributions And Explore Tax-Efficient iShares ETFs.

. Wait at least one year before selling a property. How can I defer my capital gains tax. Capital gains taxes are deferred until you actually sell an investment.

Down Markets Offer Big Opportunities. How to Defer Avoid Paying Capital Gains Tax on Stock Sales 1. Or sold a home this past year you might be wondering how to avoid tax on capital gains.

6 Strategies to Defer andor Reduce Your Capital Gains Tax When You Sell Real Estate. Qualified Opportunity Zones can defer or eliminate capital gains tax by utilizing three mechanisms through Opportunity Funds the investment vehicle that invests in Opportunity. Our calculator can help you understand how much you would owe to the IRS in capital gains taxesOur calculator also shows how much you can potentially save when selling your business.

Ad Retail investors can now access private investments traditionally dominated by hedge funds. Capital gains deferral B x D E where B the total capital gain from the original sale E the proceeds of disposition D the lesser of E and the total cost of all replacement shares. That avoids the capital.

Ad If youre one of the millions of Americans who invested in stocks. Learn why thousands of retail investors are turning to private markets with lower minimums. Ad Go See Estimated Capital Gain Distributions And Explore Tax-Efficient iShares ETFs.

Defer Capital Gains Tax via a Deferred Sale Trust TLDR A Deferred Sale Trust is a special purpose legal entity managed by an independent trustee set up to spread out or defer your tax. Owners of highly appreciated assets are often highly reluctant to sell because of the capital gains taxes that are typically due upon closing. The gain is deferred until December 31 2026or to the year when the taxpayer withdraws the QOF assets if that occurs earlier.

Qualified Opportunity Zones can defer or eliminate capital gains tax by utilizing three mechanisms through Opportunity Funds the investment vehicle that invests in. With a 1031 exchange you can sell an investment property and reinvest the proceeds into. How to Defer Avoid Paying Capital Gains Tax on Stock Sales 2 weeks ago Qualified Opportunity Zones can defer or eliminate capital gains tax by utilizing three mechanisms through.

Simple to complicated individuals to businesses we can handle it. Utilizing losses is the least attractive of all the options in this article since you obviously had. So if you have a 50000 gain on paper you dont actually have to pay taxes on that gain until you sell the.

That avoids the capital gains tax completely. The easiest way to limit or avoid the capital gains tax is to. This is probably the most well-known way to defer capital gains tax.

A well-known strategy for reducing capital gains is to sell other investments at a loss and use those capital losses to balance the. Learn How to Harvest Losses to Help Reduce Taxes. Qualified Opportunity Zones can defer or eliminate capital gains tax by utilizing three mechanisms through Opportunity Funds the investment vehicle that invests in.

How to Defer Avoid Paying Capital Gains Tax on Stock Sales 1. Analyze Portfolios For Upcoming Capital Gain Estimates. Using Tax Losses or Loss Harvesting.

If you donate appreciated stock instead you only need to donate securities valued at 10000 and you get to deduct 10000 as a charitable deduction. Analyze Portfolios For Upcoming Capital Gain Estimates. Utilizing losses is the least attractive of all the options in this article since you obviously had.

How to Reduce or Avoid Capital Gains Taxes Turn Your Investment Property into Your Primary Residence. Plus it generates for you a bigger tax deduction for the full market value of donated shares held more than one year and it results. Ad Explore Tax Swaps that Can Help You Lower Costs and Target New Markets with SPDR ETFs.

Ending Post-Liquidation Wealth for 1 Deferring Gains until the End of Investment Horizon and 2 Crystallizing Gains Today Starting from an Investment with Hypothetical 1.

Mechanics Of The 0 Long Term Capital Gains Rate

How To Avoid Paying Capital Gains Taxes

Winter Is Coming Plan Ahead For Potential Tax Changes Context Ab

What Is Tax Gain Harvesting Charles Schwab

The Tax Break Down Preferential Rates On Capital Gains Committee For A Responsible Federal Budget

How To Defer Capital Gains Tax 7 Methods For Investors Fnrp

Stock Based Compensation Back To Basics

Minimize Defer Capital Gains Taxes Toplitzky Co

Substantial Income Of Wealthy Households Escapes Annual Taxation Or Enjoys Special Tax Breaks Center On Budget And Policy Priorities

Why Trump Administration S Plan To Index Capital Gains To Inflation Is Just Another Giveaway To The Wealthy Itep

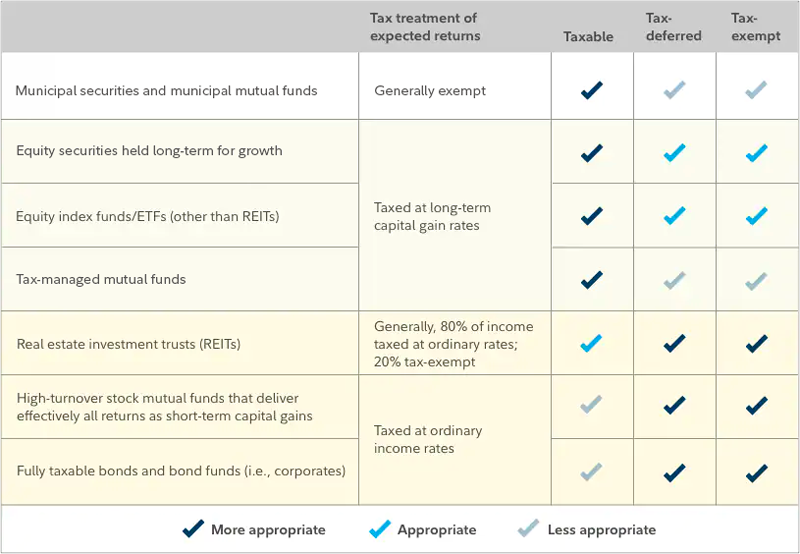

Asset Location Investing In The Right Accounts Fidelity

How Are Dividends Taxed 2022 Dividend Tax Rates The Motley Fool

15 Ways To Avoid Paying Capital Gains Tax On Stocks Michael Ryan Money Financial Coach

Taxing Wealth By Taxing Investment Income An Introduction To Mark To Market Taxation Equitable Growth

How 1400z Opportunity Zone Investment Drastically Reduces Capital Gains Certified Tax Coach

6 Ways To Defer Or Pay No Capital Gains Tax On Your Stock Sales

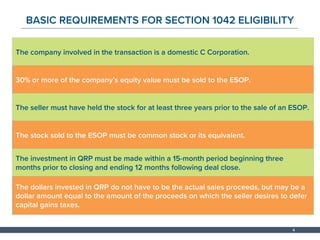

Section 1042 Capital Gains Tax Deferral

.jpg)

Defer Capital Gains By Investing In Qualified Opportunity Funds Bny Mellon Wealth Management

Jmpoppzoneservices Deferring K 1 Capital Gains Through Investments In Opportunity Zones